Aug 8

Seattle’s Sweet Success: Frankie & Jo’s Sets the Bar for Queer Friendly Business in Capitol Hill

READ TIME: 2 MIN.

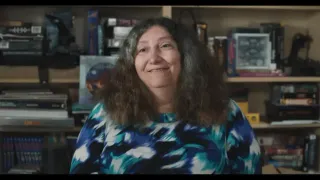

Seattle’s Capitol Hill is famed for its rainbow crosswalks, vibrant nightlife, and a history of LGBTQ+ activism and acceptance. Among its many queer-owned establishments, Frankie & Jo’s stands out as both a must-visit for tourists and a cornerstone of the local LGBTQ+ community. Founded by Megan Janes and Suzie Barnes-Janes, a wife-and-wife team, Frankie & Jo’s has become a destination for plant-based dessert lovers and those seeking an affirming, inclusive environment in one of the city’s most bustling neighborhoods .

Frankie & Jo’s offers a menu of inventive, dairy-free ice creams and popsicles made from natural, locally sourced ingredients. Flavors range from pomegranate-mint to cinnamon cream, emphasizing both creativity and a dedication to sustainability. The shop’s eco-friendly ethos extends beyond its menu, with compostable packaging and a commitment to reducing waste, aligning with the values of many socially conscious travelers .

What truly sets Frankie & Jo’s apart is its visible LGBTQIA+ ownership and the intentional creation of a welcoming space for all identities. The shop’s decor is bright and joyful, and staff are trained to provide friendly, inclusive service regardless of gender expression or sexual orientation. This approach is especially meaningful in a tourist-heavy neighborhood, where first impressions matter and the presence of openly queer-owned businesses signals safety and acceptance for LGBTQ+ travelers .

Frankie & Jo’s regularly participates in Capitol Hill’s Pride celebrations and donates to local queer organizations, reinforcing its role as more than just a business, but as a community hub. For many visitors, seeing LGBTQIA+ leaders at the forefront of a successful, visible enterprise provides affirmation and inspiration, particularly for those from less-accepting regions .

Seattle’s reputation as an LGBTQ+ friendly city is well-earned, with neighborhoods like Capitol Hill offering a rich ecosystem of queer-owned cafes, bars, and boutiques . Frankie & Jo’s contributes to this landscape by providing a family-friendly, alcohol-free space where all ages and identities are celebrated. The shop is often featured in travel guides for LGBTQ+ visitors and has been praised for its role in making Seattle a model destination for inclusive tourism .

The dessert shop’s success also demonstrates the economic power and influence of LGBTQ+-friendly businesses within tourist economies. By centering queer representation and values, Frankie & Jo’s has attracted a loyal customer base that includes both locals and international travelers seeking safe, affirming experiences .

Frankie & Jo’s continues to evolve in response to feedback from the LGBTQ+ community. Recent initiatives include partnerships with local advocacy groups, hosting pop-up events for queer artists, and providing safe space for community gatherings during Pride and beyond . The owners’ visibility as married queer women is central to the shop’s mission, offering representation that resonates deeply within the community and sets a standard for inclusive business practices nationwide.

For tourists and locals alike, Frankie & Jo’s is more than just a dessert shop—it’s a beacon of LGBTQIA+ visibility, resilience, and joy in the heart of one of America’s most affirming cities. As the world looks to Seattle for models of inclusive tourism, Frankie & Jo’s provides a sweet, sustainable example of how business can foster community and belonging for all.